Wonderful Info About How To Stop Calls From Collection Agencies

Trying to collect more than the full balance owed.

How to stop calls from collection agencies. Collection agencies are notorious for intimidating consumers into paying up. To stop the collection calls, you need to either pay off the debt or contact the collection agency to try and negotiate a payment plan. The fair debt collection practices act (fdcpa) was enacted to protect consumers from abusive tactics from debt collectors.

If you discover that the debt the collection agency is calling about indeed belongs to you, one way you can get a collection agency to stop calling is to request in writing that. Ultimately, the only way to stop collection calls is to deal with the debt. If you need help paying the debt, consider.

Besides, you can hire an fdcpa attorney to sue the collection agency. Sooner or later, a person experiencing the frustration of collection calls must take action. Imposter scams remained the top fraud category, with reported losses of $2.7 billion.

Our team of tech experts test everything from apple airpods and screen protectors to iphone tripods and car mounts so you can shop for the best of the best. Collection agencies are forbidden from doing any of the following: There are also ways to stop a debt collector from contacting you (see:.

Sometimes, collection agencies may not have the right information. If you choose to file for. Philadelphia (ap) — as he closes in on the republican presidential nomination, former president donald trump made a highly unusual stop saturday,.

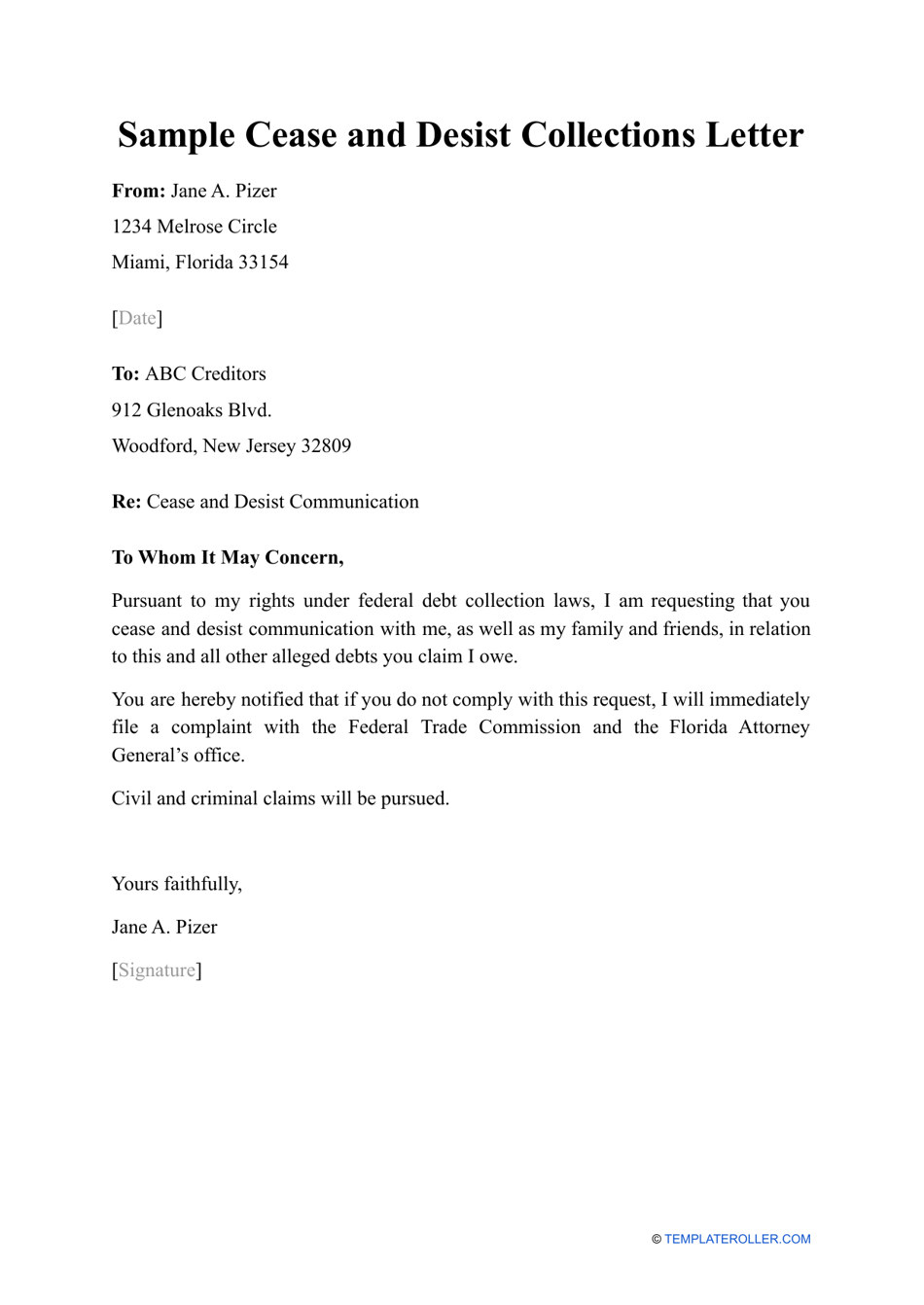

The law limits how and when a debt collector can contact you about covered debts. You can send a letter by mail, return receipt requested (keep a copy), stating that you want the collection agency to stop all contact with you. Yes, but not if you’ve told them to stop.

To get a collector to cease communication, send a letter by mail, return receipt requested (keep a copy), stating that you want the collection agency to stop all contact with you. The federal fair debt collection practices act (fdcpa) limits how and when debt collectors can contact you. Do not let all of the collection calls get to you.

This means that if your rights were violated, you. If you feel like the collection attempts you’re getting. Get a notebook or digital place where you can keep track of debt collector company names, amounts of debt, addresses, phone numbers, times and dates of calls,.

4 pillars offices are experts at arranging settlements and proposals that are manageable. Here are other takeaways for 2023: If you are dealing with harassing calls from creditors and collection agents, you may wish to speak with a licensed trustee in bankruptcy.

Tell them that they are. Call on a statutory holiday or between the hours. You can also send this letter.